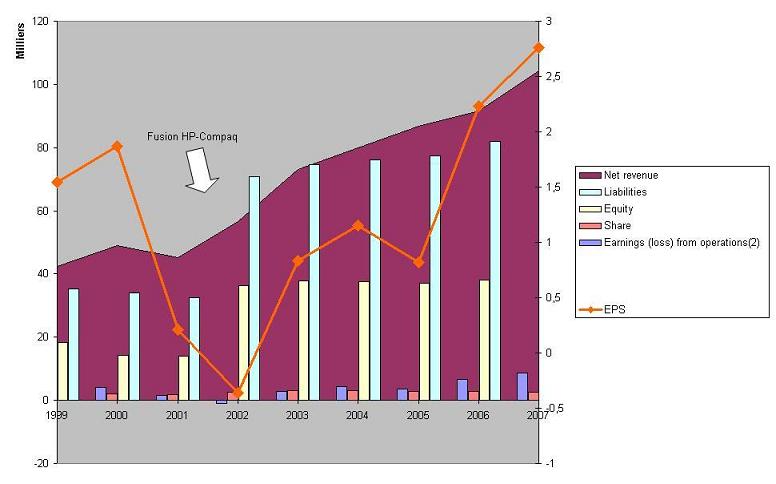

(click right and display the graph if you want to read)

After the merge, liabilities related to revenue soared. The management focused on maintaining the share value of capital stable meanwhile trying to get the operations profitable again . According to the graph above, we could state that the Compaq swallowing finished in 2004, the year when Carlina Fiorina left HP.

Then, what was the game ?

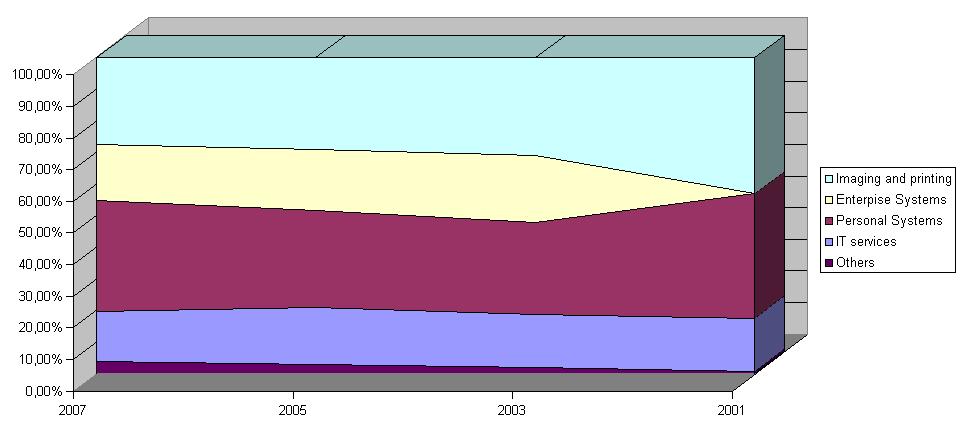

(click right and display the graph if you want to read)

In 2001, HP what very good in supplying high end enterprise servers while personal systems market pulled the growth. By then, Dell was in the market and in good shape to compete it with IBM. If Compaq was in the market as well, it was undergoing big concerns in internal operations. HP made the first move which pushed it again in the market. For the past few year, Personal systems division really drives the growth.

In 2007, we could say that it managed to win against the Devil. But, times changed. IBM sold its personal division to a chinese company. If Dell undergo difficulties which lead Michael Dell to take again the reins of the company, it is not totally due to US competitors, now China belongs to the landscape too. This leads IBM to sell its personal systems division and to develop a global services strategy with a big chunk located in India.

The business vision is : “Global IT services strategy open access to a big market with a steady and recurrent business. Moreover, this strategy drives the growth of high-end enterprise servers against low-end and middle range personal systems and servers less suitable in Datacenter”.

The next step is cloud computing. With outsourcing offering, the market was more or less limited to big companies able to manage global contracts when streamlining their IT operations. With cloud computing concept, computing power is seen like energy. It may be provided everywhere like a commodity. Small and medium enterprise would afford then to be connected. To be able to compete on this market is the real motivation of the acquisition which may result in a consolidated revenue of $38 billion in services behind IBM with its $54 billion.

Compared to Compaq merge, this time HP will pay for it, this means that in whatever way a ROI will be expected. Other thing, HP again is a follower, not only in numbers within the market, but in vision as well. Unlike winners like IBM or Apple, HP is not visionary. Would it be the very challenge of Mark Hurd for the next years ?

What big companies may expect from this move ? For the long run significant enhancements on high end enterprise servers may have good impacts on the costs. This may contribute to improve their IT assets management. On the other hand, I am not sure that cloud computing may bring dramatic improvements since these companies already outsource significant parts of their IT operations. But indirectly, if small and medium enterprise business see their business improved, as they use to be subcontractors of big companies, it may contribute to improve their business too.